“Where there is risk, there often is reward, but the scales tip favorably when informed decisions lead the charge.”

Unknown

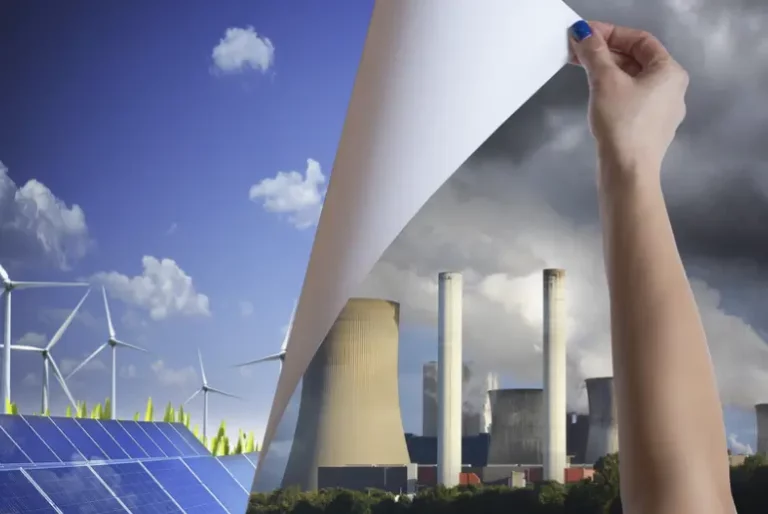

As global energy markets pivot towards sustainability, renewable energy emerges as a lucrative yet complex investment landscape. This deep dive explores the risks associated with renewable energy investments and how investors can navigate these challenges to harness significant returns. Enhanced with the latest industry data and case studies, this article offers a detailed perspective on balancing the scales between risks and rewards in the renewable energy sector.

The Dynamic Nature of Renewable Energy Investment Risks

Investing in renewable energy involves unique challenges that can impact returns and operational viability. Understanding these risks is crucial for developing strategies to mitigate them effectively.

Industry Insights:

- According to a report by the International Renewable Energy Agency (IRENA), global renewable energy capacity is expected to grow by 50% between 2019 and 2024, primarily driven by solar and wind energy expansions.

- The Global Sustainable Investment Alliance notes that sustainable investment assets reached $30.7 trillion in 2020, a 34% increase from 2016, indicating strong market confidence in renewable energy.

Real-World Application:

- A European renewable energy fund faced significant challenges due to fluctuating policy environments and tariff changes. By diversifying its portfolio across geographies and renewable sources, the fund managed to stabilize returns, demonstrating the importance of strategic risk management in renewable investments.

Strategic Approaches to Mitigating Investment Risks

Geographical and Technological Diversification: Investing across different regions and technologies can shield investors from localized adverse impacts such as policy changes, natural disasters, or technological obsolescence. Diversification helps stabilize returns and reduce dependency on a single market or technology.

Advanced Due Diligence and Real-Time Monitoring: Implementing thorough due diligence before committing capital and continuous monitoring of existing investments are vital. Advanced analytics and AI tools can provide real-time insights into project performance, market conditions, and regulatory changes, enabling proactive management and decision-making.

Leveraging Insurance and Hedging Strategies: Insurance products and hedging instruments can protect against specific risks like equipment failure, natural disasters, or currency fluctuations. These financial tools can buffer investors from potential losses, ensuring more stable financial outcomes.

The Investment Opportunity in Addressing Renewable Energy Risks

Regulatory Stability and Incentive Programs: Governments worldwide are bolstering their support for renewable energy through stable regulatory frameworks and incentives like tax rebates and grants. Investors attuned to these policies can capitalize on such supports, reducing investment risks substantially.

Innovation and Efficiency Improvements: Investment in R&D and innovative technologies can yield higher efficiency and lower costs in renewable energy projects. Staying at the forefront of technological advancements allows investors to enhance project viability and returns.

Partnerships and Collaborations: Collaborating with experienced developers, governments, and other financial partners can spread risk and pool expertise. Such partnerships often lead to better resource allocation, risk sharing, and increased project success rates.

Conclusion: Capitalizing on the Future of Renewable Energy Investments

The renewable energy sector presents a promising avenue for investors seeking to align with global sustainability goals while achieving substantial financial returns. By understanding and actively managing the inherent risks, investors can position themselves to capitalize on the vast opportunities within this rapidly evolving market.

As the world continues to demand cleaner and more sustainable energy solutions, the market for renewable energy investments will likely see significant growth. Investors who navigate this landscape with a keen eye on risk management and strategic positioning will not only contribute to a greener planet but also enjoy the financial rewards of their foresight and innovation.